Digital Art Review: June 2023

Strong fundamentals despite poor sentiment. Fidenza & Ringers ascend to new highs. Squiggles remain strongest store of value. Market for new art releases is recovering.

Those who delve beneath the surface will reap the rewards

At a time when negative sentiment is peaking and prices have dropped another 20-30% in June, it might seem tempting to write off digital art and shift focus. Yet, doing so would be a mistake as there is much more beneath the surface than immediately apparent.

Although digital art prices aren’t immune to the sharp contraction in valuation of the top-tier NFT projects like Bored Apes and Azuki, the fundamentals of digital art remain strong. Valued at $2 billion, digital art continues to evolve into an independent asset class, gradually capturing attention of traditional collectors.

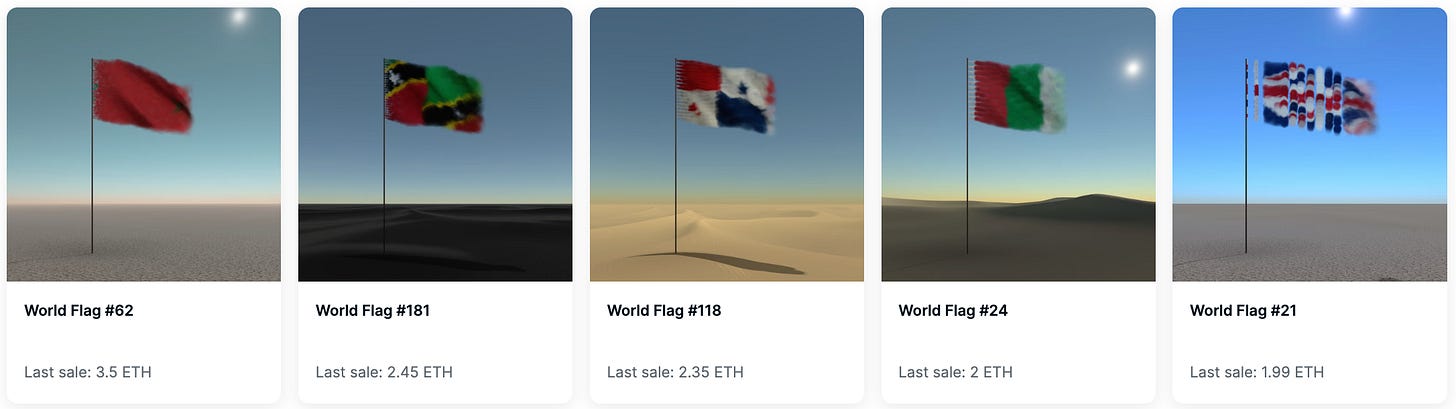

The market for new art remains fragile. Over 90% of new capital flows to the established collections like Squiggles, Fidenza, and Ringers. Nevertheless, thoughtful releases – reasonably priced ($200-$500) small collections (under 200 pieces) – such as Invisibles by Ismahelio and World Flag by John Gerrard are doing well.

Premium art, especially the rarest pieces, have been most resilient. Sotheby’s held another successful auction of the 3AC generative art collection, raising $11 million, including $6.2 million paid for ‘The Goose’ (rare artwork in Dmitri Cherniak’s Ringers collection). Fidenza and Ringers are trading at the highest levels in six months. Vera Molnar, the biggest name in generative art, is releasing her first ever collection of 500 pieces on the blockchain in the end of July, with prices starting at $40,000.

From our constant engagement with artists, collectors, and builders, our faith in the future of the digital art movement remains stronger than ever. While there’s no guarantee that prices don’t fall another 30% or more, we believe this is a great time to start accumulating grails, which is exactly what we’re doing at Grail Capital.

Yours truly,

Jean-Michel and Tim

Market trends (last 30 days)

Digital art 21%↓ vs ETH 0%↑ vs NASDAQ 6%↑

Collectibles 23%↓ (CryptoPunks 20%↓ Bored Apes 23%↓ Azuki 46%↓)

Generative art 1%↓ (Squiggles 21%↓ Fidenza 15%↑ Anticyclone 4%↑)

AI art 3%↓ (Genesis 2%↑ Life in West America 56%↑ podGANs 7%↓)

Market trends (2023 year to date)

Digital art 22%↓ vs ETH 58%↑ vs NASDAQ 19%↑

Collectibles 23%↓ (CryptoPunks 3%↓ Bored Apes 29%↓ Azuki 21%↓)

Generative art 14%↑ (Squiggles 6%↑ Fidenza 40%↑ Anticyclone 15%↑)

AI art 105%↑ (Genesis 215%↑ podGANs 83%↑)

Digital Art: The Next $1 Trillion Asset Class: Since its publication in March, our report was read by over 5,000 art collectors, private wealth managers, entrepreneurs, and investors. It’s the result of our colossal effort which included 100+ conversations with the leading artists, collectors, and entrepreneurs, and over 200 hours of research and writing. Lots of stats and insights into the digital art market: overview and breakdown of major digital art categories, market value of the top-100 collections, price changes since the release, performance comparison to financial indices, and more.

NFT setback masks digital art’s strong fundamentals

Digital art, catalyzed by a downturn in the cryptocurrency market, has progressively evolved into an independent asset class, increasingly decoupling its prices from Ethereum (ETH) and Bitcoin (BTC). Premier digital art collections such as Squiggles, Fidenza, and Ringers have demonstrated resilience as a store of value, capturing the interest of traditional art collectors and investors who were not previously engaged in the crypto ecosystem.

As advancements in blockchain technologies facilitate simpler fiat-to-crypto onramp and secure digital asset custody, the appeal of digital art grows stronger. At Grail Capital, we are receiving a burgeoning number of inquiries every week from private banks and family offices. These institutions seek insights into the digital art movement, guidance for their digital asset strategies, and innovative investment products for their technologically inclined, high-net-worth clients.

A vast reservoir of capital, estimated in the hundreds of millions of dollars, is poised to be injected into the digital art sphere. Nonetheless, a significant impediment is the perceived connection between digital art and NFT projects. Despite their shared foundation on blockchain technology, the intrinsic differences between these two digital asset types are often overlooked, leading to erroneous categorization.

Subsequently, the fortunes of digital art become unduly influenced by the performance of NFT projects. NFT projects generally promise utility, from exclusivity to status to merchandise, whereas art remains purely art, devoid of utility or expected function. The issue arises when the vast majority of NFT projects, built predominantly on hype, speculation, and ponzinomics, fail to deliver on their promises. This failure not only defrauds investors but also generates a negative spillover sentiment toward digital art, particularly when top-tier projects exploit their holders, whether intentionally or not.

The launch of the new collection Azuki Elementals by the top-3 project Azuki triggered a major collapse in NFT prices, dragging with it digital art valuations. “The team ran a FOMO-inducing, mass-liquidity-extracting event – a $40M mint for an additional collection – at a time when the market was already down bad and struggling for liquidity,” wrote digital art collector and entrepreneur Zeneca.

There’s an 80% overlap between collectors of digital art and collectibles such as Azuki. When these people spend $40M on Azuki Elementals, there’s less capital for digital art. Moreover, when prices tank, the majority of these people rush to cut their losses and sell parts of their art collections to make up for the lost capital. In a large thriving market, it wouldn’t be a zero-sum game. However, at a time when monthly sales volumes are less than $300M, digital art and collectibles are tied at the hip.

Amid market fragility, select art releases thrive

Capital scarcity is posing a significant challenge for artists planning new collection releases. Active wallet numbers have suffered a 90% decline year over year, accompanied by a consistent outflow of capital as current collectors seize the opportunity to realize profits.

However, this landscape encourages platforms such as Art Blocks and Pace Verso to be more discerning regarding their releases. Greater consideration is now given to collection parameters such as piece count and selling price.

Looking at the top-5 generative art collections launched in June, three have upheld their value, with prices exceeding their initial sales. Notably, these collections have less than 15% of their pieces listed for sale. While this is above the 5% average observed across the top-10 generative art collections, it falls significantly below the 30-40% seen in the majority of more recent launches.

The sweet spot seems to be 200 pieces released at $200-$500. This compares to dozens of 1,000-piece collections released every month at $10,000-$15,000 during the late summer 2021 – the all-time market peak.

Premium collections hold their ground

The resilience in the world of digital art rests primarily within the sphere of premium collections, particularly within the rarest pieces found among the top ten generative art collections.

Sotheby's second Three Arrows Capital (3AC) digital art sale netted $10.9 million, including Dmitri Cherniak’s The Goose for which a prominent collector Punk6529 paid $6.2 million, exceeding the original expectations of $2-$3 million. Other works, including Tyler Hobbs’ Fidenza #479 ($622,300), Snowfro's Chromie Squiggle #1780 ($635,000), Larva Labs' Autoglyph #218 ($330,200) and Kjetil Golid's Archetype #397 ($330,200), also sold for higher than their estimates.

(For the context, Sotheby's has been tasked with the sale of digital artworks from Three Arrows’ art collection, formed as part of 3AC's asset portfolio in 2021. The hedge fund filed for bankruptcy last year and its liquidator Teneo outlined its intention to sell the expansive list of digital artifacts to recoup investors’ capital.)

The Goose became the second-highest sale ever for a generative piece. The artwork is part of the Ringers collection launched on Art Blocks in January 2021. While the most affordable Ringer is listed for sale at $80,000 (40Ξ), the Goose fetched 80X more.

“Long-form on-chain generative art is an act of faith by the artist and the minter,” Punk6529 explains. “Unlike almost any other art form, neither the artist nor the initial collector know what the piece will be at the moment it is collected.”

“There are 1,000 Ringers. Nobody, Dmitri Cherniak included, knew what they would be when his code was deployed to the blockchain. The Goose looks like nothing in the collection and however many times you would have run the algorithm before or afterwards, you would not expect to replicate it.”

“It says something fundamental about how long-form generative art works – that the algorithm can surprise everyone (even the artist), and that the algorithm is itself a player on the field.”

Since the beginning of the 3AC collection sale two months ago, Sotheby’s has grossed $17 million. Seeing enormous demand for premium generative artwork, the auction house announced in June the launch of its own generative art platform and its first project – collaboration with Vera Molnar, one of the leading generative artists in the world, and Martin Grasser. Vera’s collection of 500 pieces will be released on July 26. The auction will open with a starting price of $40,000 (20Ξ) and go down until the items are either sold out or the price lands at its resting price of $4,000 (2Ξ).

DeepBlack is a sleeping giant! Thank you for finally including them!